In the first part of this post, I looked at a few essentials that need to be considered when moving to a freelance role, including motivation, company structure, banking and marketing. This time we look at the slightly less glamourous, but just as important, subjects of tax and record keeping, invoicing and useful software. Again, I hope this post is useful for any other software developers considering going freelance.

Tax and record keeping

Whether you decide to use an accountant or not, it’s essential to keep records relating to your incoming and outgoing transactions. The Business Link site has an excellent guide on setting up a basic record-keeping system, and have some sample spreadsheets that you can use as a starting point. The records include:

- Cash sales and purchases/expenses book

- Sales ledger

- Purchase ledger

These records will give you a thorough overview of any money going into, and out of, your business account.

When you open your business account, it is likely that you will also have the option to open a deposit account at the same time. This can be used to set aside money to pay your tax bill each year. For sole traders, income tax will be calculated when you fill in the annual Self Assessment form.

You can reduce your tax bill by claiming tax relief on business expenses. Business expenses could include advertising, travel costs and legal fees. If you work from home, it can also include part relief on costs such as broadband and even electricity. The following links on the HMRC site give further details:

- Tax allowances and reliefs if you’re self-employed

- Types of allowable expenditure when working from home

Invoicing

If you’re not invoicing, you’re not going to get paid. Therefore, you must keep on top of your invoice management. Freelance Advisor has a set of invoice templates that can be used as a starting point for creating your own. Make sure you issue invoices promptly, and be clear about your payment terms. Standard terms are 28 days, but you may wish to shorten this if you are just starting so you can get money into your business more quickly. Don’t be afraid of chasing late or non-payment of invoices.

As your business grows, you may wish to consider using a software package that manages both accounts and invoicing. Currently topping freelancesupermarket’s league table of accountants is Crunch. Crunch can handle both accounting and invoicing for a flat monthly or yearly fee. If you are a sole trader you need to switch to a limited company to use their service, a task which they will advise you on.

Useful software

There is a plethora of free software available to make freelance life easier.

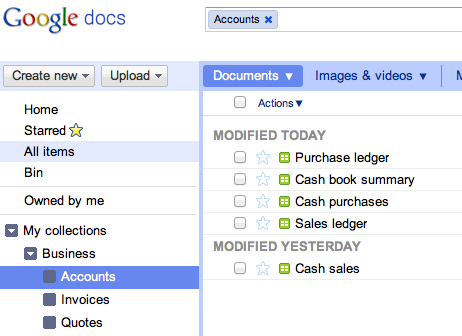

Google Docs is an excellent way of organising documents, spreadsheets and databases for your business. One big advantage of using this is that your documents will be available from any machine that has internet access. The screen grab below shows a simple collection that I have put together to organise my documents. The top level collections are Accounts, Invoices and Quotes.

Skype is a great way of keeping in touch with your clients by instant messenger, voice or video call.

Ta-da List is a simple list manager, great for managing your “to do” list of day-to-day tasks.

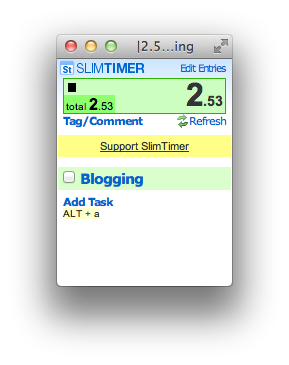

SlimTimer is a simple browser-based application for tracking time spent on tasks. If you are billing by the hour, this is an excellent way of recording time spent working on a client’s project.

Summing up

One of the major challenges of freelancing is being able to juggle the actual work with the business administration side of things. As long as you are able to set aside a few hours each week to keep on top of the administration, you will have no problems. I hope that my experiences thus far can be of use to others setting out on the freelance path.